Atacan Energy tests and incorporates a variety of economic

scenarios into models to evaluate relative effects. Modeling is

especially vital in analyzing how projects pay out under various,

complex production-sharing contracts and concession and service

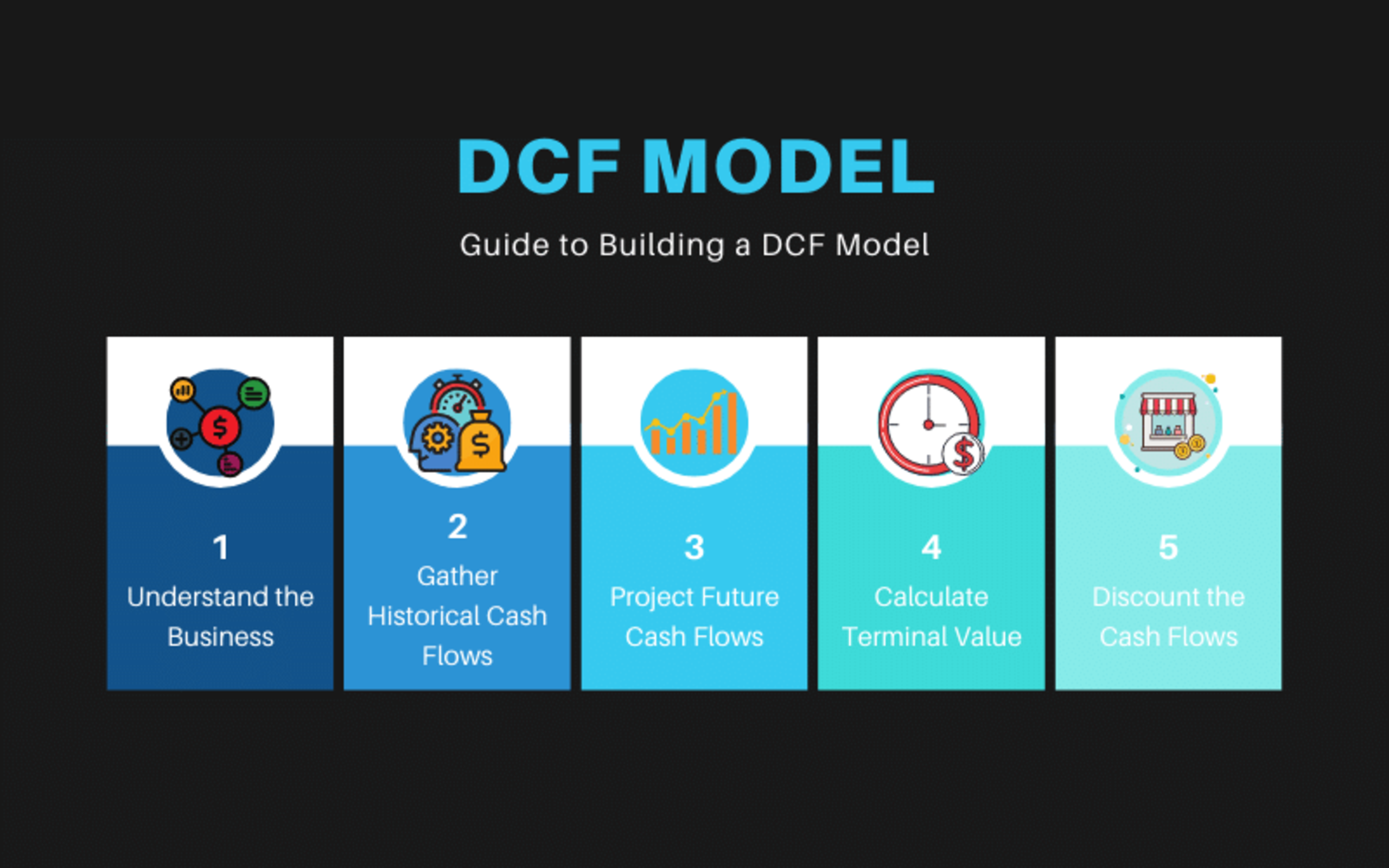

agreements. Atacan Energy constructs discounted cashflow (DCF)

valuation models that allow for the input of various production/cost

scenarios. We also customize DCF model layouts for alignment with

internal modeling platforms.

The DCF model enables an evaluator to perform financial analyses of

the project at different points in its lifecycle. Atacan Energy

performs incremental analysis when evaluating two complementary

cases — a base case and upside case. Our DCF models incorporate

price and inflation rate assumptions, working interest, taxation

items, working capital adjustments, net present values, internal

rates of return, payback, HSE (health, safety and environment)

impact, abandonment costs, charts and outputs to profit-and-loss

statements and balance sheets.

Atacan Energy also provides clients with instructions detailing the

architecture of the models. The firm conducts in-depth economic

evaluations using the latest proprietary and commercial software

programs. Atacan Energy also receives economic models from clients

and reviews them for compliance with all the terms of contract

agreements.